A Policy Framework for Radical Moderates

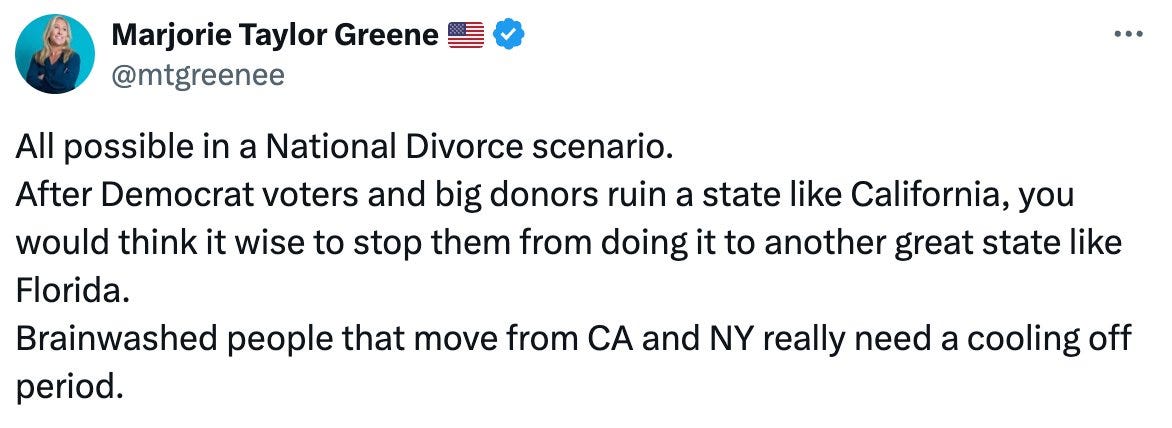

What the hell am I doing writing about politics again? Somehow I haven’t learned my lesson. My last attempt resulted in a sitting member of US Congress calling for civil war:

I couldn't help it. Guess that makes me a Silicon Valley thinkboi.

Some context

My political views aren’t “conventional;” they don’t fit neatly into any party or policy position — democrat or republican, liberal or conservative, libertarian or green.

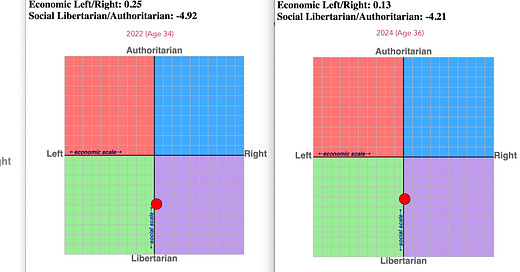

But I’ve always been a “moderate.” In the last ~decade I’ve moved slightly to the center from the left, but I was never really clearly left or right:

Through hundreds of conversations — ranging from Romney staffers to people who worked on Obama and Hillary campaigns to fervent Trump supporters — most people tend to agree with the majority of views I’ve shared in face-to-face conversations.

But somehow, my tweets from 2021 really riled people up, on both sides of the aisle. Why was this?

Paul Graham had a great post defining an “accidental moderate”:

Intentional moderates are trimmers, deliberately choosing a position mid-way between the extremes of right and left. Accidental moderates end up in the middle, on average, because they make up their own minds about each question, and the far right and far left are roughly equally wrong.

I realized that I might have been “in the middle,” but I infuriated ideologues on both the far-left and far-right by calling out the flaws in each. On Twitter (and online in general), the nuance fades away and you hear what you want to hear.

Worse: the loudest voices on either side branded any opposition to key views as heresy. (Tim Urban’s What’s Our Problem is a must-read on polarization and partisanship.)

Further, applying labels really killed the discussion and made it tribal. We’re so conditioned to be married to “my party,” “my candidate,” and “my President,” that dissenting views — even those valid in principle — collect dust in a corner of our brains.

I think we shouldn’t give a damn about labels and party barriers. There’s much more that unites us than divides us, except we can’t seem to solve anything and end up just stepping all over each other.

Which brings me to the reason I’m writing this: By leaving it to the ideologues to generate policy, we're sacrificing real discussion in favor of culture wars and name-calling. Instead, I think it’s crucial for rationalists & moderates to share orthogonal proposals, concepts, and ideas. The suggestions below can be taken individually or together. They mix and match positions that belong to the Libertarian, Democrat, and Republican parties, along with a bunch of wacky ideas that belong to no party at all.

I know these proposals are politically impossible. That’s almost the point. By losing the constraints of what’s feasible, by going well outside the Overton Window and just wondering “what if”… perhaps we can stop riling people up and can spark some real discussion.

Never doubt that a small group of thoughtful, committed citizens can change the world; indeed, it's the only thing that ever has.

If you have comments, ideas, or suggestions, I’d love to hear them. Please comment on this post or shoot me a DM (@haridigresses), or comment on it in this Notion doc (requires login) or in this Google doc (preserves anonymity).

Let's get into it.

Education

College isn’t for everyone, and we need to stop telling kids that it is.

Dramatically increase the intensity, challenge, and bar for K-12 education. Heavily support kids who can’t keep up with after-school lessons, but don’t hold back the rest of the class. There will always be a distribution of outcomes but that’s okay.

Most people have some kind of genius within them. There are many different kinds of intelligence: scientific and mathematical, sure… but art, music, hand-eye coordination, social, creative problem-solving, endurance. But this doesn’t mean that everyone’s equally smart. There are still distributions within each kind of intelligence. Invest more in finding and fueling this hidden potential, not in serving the lowest common denominator.

Focus on enabling and unleashing the top 5% of kids in each field.

Generally, the top 1% of a field are more impactful to society in 50 years than the bottom 50% — Jonas Salk, Henry Ford, JP Morgan, General Patton, Michael Jordan, Ella Fitzgerald, each had a bigger impact than a thousand other “average” people in their fields, combined.

Of course, some of that is luck, but it’s clearly possible to identify savants early on.

If societal progress generally comes from the outliers, then every child should have the same basic foundations, but the gifted children should receive disproportionate academic investment.

Heavily invest in trade schools. Plumbers are likely to have a more secure professional life than most white-collar workers in the age of AI.

Stop talking about student loan forgiveness. Subsidizing the cost of something makes the price go up. If you don’t believe this, take an entry level economics course.

Fix the broken parts of the student loan system:

Allow student loans to be discharged in bankruptcy after 7 or 10 years

Go after predatory student loan lenders — just like we go after predatory practices in any other financial sub-sector. They currently have an unregulated oligopoly.

Institute pay for performance in education. The goal of the education system isn’t to “protect teachers”, it’s to educate and elevate students. The best teachers should make 2-5x the average because their work is massively impactful to society. Fire the bad teachers.

Disband teacher’s unions, solely because they will fight pay-for-performance tooth and nail.

(Both the pay for performance and disbanding unions points applies to all public sector organizations. There’s a slightly better argument for private sector unions to create leverage, but the government isn’t profit-maximizing the same way.)

Continue experimenting with charter schools, vouchers and other means to raise the bar in thoughtful ways. Experimentation should never be a political issue.

Institute similar outcome-oriented systems with colleges: every accredited institution should be required to publish post-graduation outcomes on a 0, 1, 3, 5, and 10 year horizon. It’s easy to crowdsource this with simple authentication of alumni email addresses.

Start taxing endowment funds in excess of $250K / enrolled student.

Civic Discourse

I’m pro “Woke 1.0” but anti “Woke 2.0”.

The phrase “woke” originally referred to the fact that there are embedded biases in society, which… of course there are. This isn’t saying “everyone’s racist”, which is a silly cudgel. It’s simply saying we’re all subject to heuristics, and maybe we should be mindful of that. If you don’t recognize that… I’d recommend taking an entry-level psychology course.

But that should not pervade every aspect of how we operate as a society. It shouldn’t turn into an us vs. them. It should be used to fuel guilt and resentment. It shouldn’t be used to cancel people — a trial-without-jury in the court of public opinion. We should find ways to build bridges, not burn them. This toxic culture where “if you’re not for me, you’re against me” is what is being characterized as “woke”, and the over-correction has undermined the original goals.

No safe spaces at universities. Life doesn’t have safe spaces. Resilience (within limits) makes us better people.

We should measure and encourage diversity of all kinds. This isn’t a dog-whistle, by the way; we should measure and improve demographic diversity as well. But if we listened blindly to “intersectionality,” then there’s only one acceptable hierarchy of diversity, which is silly. There are many ways by which people have overcome adversity in their life, not all of which are visible to the eye.

Encourage this not because some academic taught about right and wrong, but because in most cases in everyday life, breadth of experiences in a group results in better decisions and outcomes.

When seeking to improve diversity, work on top of the funnel, and avoid quota-based systems. Certainly never tie incentives to diversity outcomes, because this always results in unforeseen consequences.

Bring back the Fairness Doctrine, which encourages the discussion of opposing viewpoints.

Find ways to boost other incentives and business models besides just ads (which lead to dopamine, outrage, and clickbait) — be it mainstream media or social media.

Government

End gerrymandering — constitutionally limit voting districts to N edges.

Constitutionally outlaw money in politics. Citizens’ United is the most harmful thing to happen to our society in decades.

Switch to a true popular vote, or actual run the electoral college the way it was designed. The current system gives us none of the benefits of a representative democracy, with all the downsides and risks of a populist-driven system.

Constitutionally add an upper limit for age of elected officials. If someone has to be >35 to run for President, there’s no reason they shouldn’t be limited to <75.

Start passing more constitutional amendments. We haven’t passed a serious amendment in >50 years (no, the 27th Amendment doesn’t count).

Everyone’s despondent because we think the American Experiment has failed. But it hasn’t. We’ve just stopped experimenting on the American Dream.

The US Code is just like computer code. It needs a massive refactor. In the absence of this, any system of rules will gradually develop cobwebs and cruft.

Massively increase the budget for the US Digital Service. If you aren’t familiar with this agency, you should take a look: they just created a free tax filing system, so most people never have to pay TurboTax or H&R Block another dime. Not all heroes wear capes or uniforms.

No person who’s never run a business should every become FTC Commissioner.

Ban members of congress from trading stock. At the very least prohibit insider trading with a restricted list (like every other employee of any company that has material non-public information).

Institute term limits for members of congress.

Avoid adding regulation to make things easier. Even if you mandate “make this thing easier”, complying with those regulations always, always ends up making it harder.

If you want to disincentivize a behavior, don’t ban it. Just add red tape.

Speaking of, let’s please just build more damned housing.

Social Services

Stop subsidizing things that are seeing massive price increases (healthcare, education). Again, Econ 101.

Raise the retirement age (for social services) to at least 70. I know this stiffs people who have already contributed a lot into the system, but quality of life has massively improved and 70 isn’t what it used to be. It sucks, but we need to cut off the finger to save the hand.

Rewrite the tax code. Literally, throw it out and start over.

Encourage efficiency in healthcare through vertical integration. There are a handful of local healthcare networks that do this brilliantly (e.g., Kaiser). Seed more of these organizations.

Start a national public chargemaster for hospitals. If hospitals don’t participate, penalize them, but still allow patients to upload their bills (AI can now easily extract the line items and reverse engineer every hospital’s chargemaster if enough people are made aware of this resource).

(Actually, someone should probably build this as a public service project in a weekend.)

Run experiments with Universal Basic Income. We just don’t know enough here, but it’s possible that we should replace all social safety nets with just one check per month, tied to the person’s tax return from the prior year.

Stop “harm reduction” initiatives. This is simply attempting failed, unproven theories to help people who just need help (instead of enablers)… and along the way, massively reducing quality of life for the remaining 95%+ of the population.

Invest in mental health facilities and shelters. Once that’s done, there’s really no good reason not to enforce safety and sanity on the streets (crime, hard drug dealing & use).

End subsidies for things that are slowly killing us, like corn (which is mostly used to make cheap high-fructose corn syrup). Why is farming a more noble profession than being a car mechanic, or school bus driver, etc. — none of whom receive subsidies?

More ruthlessly prosecute things that are poisonous. PFAS / PFOA are forever chemicals which DuPot and 3M have been introducing into our water table with gross negligence, and should be sued out of existence. If we could do it for tobacco companies.

Centralize and streamline bureaucracy. There’s no reason every county should reinvent its own building codes. There should be a nationally developed and maintained set of “template” regulations — let’s say 10 or 20 types, some better suited to hot vs. cold weather, some suitable for hurricanes vs. earthquakes. Each county can adopt one for its weather, identity, and preferences. The same should apply to health inspections, business licensing, environmental regulations, etc., albeit perhaps a lot fewer than 10 or 20 for these.

Encourage superblocks, autonomous vehicles, public transit, greening of cities. Disincentivize ground level parking lots.

Economic & Tax Policy

This one requires a little chewing on: the US should maximize long-term gross profit in engineering the economy (to be clear, not operating profit):

Gross profit = the revenue (taxes) generated by the country, less the marginal cost (social security, medicare, safety nets, etc.).

Every other budget line item (defense, government agencies) — and even those line items of taxes and social services — should be aligned to maximizing the absolute gross profit.

If a policy change would increase high-quality immigration (cough cough, H-1B, O-1), we should dramatically encourage those.

If a policy change results in better quality of life and productivity for the population (e.g., preventative medicine) we should invest in those.

If a measure increases the risk of a shrinking economy (and hence revenue), it should be avoided — e.g., a top marginal tax rate of 60%+ will result in capital flight. Regardless of what you think of the “morals” of taxation, this is just the logical, pragmatic approach to taxes.

Massively invest in building out nuclear energy, reduce dependence on everything else. PSA: solar and wind aren’t as “green” as you think, they require such a massive amount of load-balancing and environmentally-damaging rare earth metal mining that they’re of questionable impact to the environment. There’s a reasonable argument that they’re just an opiate for the masses, to make us all feel better that we’re being earth-friendly. (The same applies to ESG investing and recycling btw. Most “ESG” stocks aren’t, and most recycling goes into a landfill.)

Disband corrupt, kleptocratic organizations that keep the economy and society from working well. The underlying missions are still valid, but their operation has just become massively bureaucratic, and their methods constitute a bigger tax to society than any bill paid to the IRS. Just shut them down and start over:

SEC

FTC

Federal Reserve

Department of Education

EPA

VA

CDC

FDA

…

On the other hand, there are many agencies which are generally known to be well-run (not first-hand information):

USDA

FDIC

IRS (I’m going to get a lot of flak for this one, aren’t I)

DARPA

…

Continue to invest in defense spending. That’s an intentional choice of words; this is simply because our ability to project power and protect trade lanes makes us (and the rest of the world) more prosperous.

Ending on a fun one…

Replace all taxes (income, sales, property, estate) with a single wealth tax

The principles the US was founded on included disbanding oligarchies, which generally has to do with wealth, not income.

It doesn’t make any sense that a person who has a $5,000 net worth but makes $100,000 / year is taxed the same that as someone who has a $5,000,000 net worth and also makes $100,000 / year.

If we instituted a progressive system, e.g.,

<$100K net worth, 0%

$100K - $1M net worth, taxed at 1%

$1M - $10M net worth, taxed at 2%

$10M - $100M net worth, taxed at 3%

$100M - $1B net worth, taxed at 4%

>$1B net worth, taxed at 5%

It should end up being roughly revenue neutral but much more incentive aligned and eliminating a lot of silly behavior.

Right now, someone worth $500M probably generates 12% on their net worth anyway = $60M, and is paying probably 25-30% in taxes so $15-20M. A wealth tax system would tax that person at 3-4%, which is…. $15-20M.

Top down, the math also checks out; US household net worth is ~$150T and corporate market cap is ~$50T. A ~3.5% weighted average tax rate is ~$7T, which is approximately the total of the US federal, state, and local budget.

It avoids dumb games like tax loss harvesting, timing sales for long term, or rushing to buy or sell things on December 31.

Do not tax illiquid assets in the “traditional” sense. This is the biggest problem with all wealth tax proposals to date. Instead, tax them in-kind. E.g., if a taxpayer holds 10,000 shares in a private company for 3 years, and my net worth is $250,000, $500,000, and $1,200,000 during those 3 tax years, then when I sell it, I would have to cough up 1% + 1% + 2% = 400 shares’ worth of proceeds when I sell it. If I sold 5,000 shares, then the government gets 4% of those proceeds and the remaining 5,000 shares continue to accrue a fraction to the government each passing year.

Philosophically, these illiquid assets also offer some substance to back up the US debt. In reality, the US debt is very much “collateralized” by the assets and receivables of the federal government (colloquially called the “full faith and credit” of the government, but this is really what it’s getting at). But when thinking more explicitly of “assets” which are owed to the government by its taxpayers, it’s more apparent why US Treasuries aren’t just backed by “faith” but rather by real assets.

Also philosophically — it will both be a fair & progressive tax system, while also making it clear that the wealthy are more than pulling their weight.

The top 1% of income earners today pay (more than) their “fair share” of taxes, but because of the complexity introduced by a dozen different kinds of taxes, no one thinks that.

By simplifying the system, it becomes unequivocally obvious that those with a $10K net worth pay $0 in taxes (in fact, have a negative tax rate due to social programs or possibly UBI)…

… while the ultra-wealthy have 4-5% eating away at their wealth every year (obviously offset by returns on their wealth).

All of this is as it should be; the wealthy should indeed pay more than their proportionate share.

But we should call a spade a spade. Which one might optimistically believe would help with class warfare.

Sam Seaborn on the West Wing put it much more eloquently:

The top one percent of wage earners in this country pay for 22 percent of this country. Let’s not call them names while they’re doing it, is all I’m saying.

Corporations would be taxed similarly in kind — they would simply issue the government a certain number of shares each year tied to their market cap.

For publicly listed companies, the government would have a selling program where a portion of these assets would be sold to cover expenditures, and the rest would continue to be held to cover social programs.

Because of the massively long time horizon on which the government can operate, it can ride out market cycles.

If done correctly, the taxpayer should never have to think about it. It should just get settled in the background in the course of income and sales, just the way that income taxes are withheld.

If it sounds complex, just remember that we’ve set up far more complex systems (e.g., your brokerage account automatically deposits fractional shares for stock dividends; this isn’t any more complex).

Of course people and companies will try to game it and find loopholes, but… not any worse than the way income tax is gamed today.

This all-tax-for-wealth-tax is absolutely crazy. It will never happen. But I’ve talked to dozens of people about this and the consistent conclusion has been it’s at least worth thinking about.

In fact… most of these proposals will never happen. But we really have to get in the habit of talking about weird policy ideas, because that’s how we come up with creative new solutions to old problems.